Refinery Closures Accelerate: ~21% of Global Capacity at Risk by 2035

Between 2025 and 2035, the global refining industry is expected to undergo a dramatic transformation driven by demand shifts, decarbonization pressures, and rising competition from mega-integrated complexes. According to Wood Mackenzie, approximately 101 out of 420 refineries worldwide, representing 18.4 million barrels per day (mb/d) or 21% of global capacity, are at high risk of closure by 2035.

The key differentiator will be petrochemical integration. Only 29 of the 101 at-risk refineries are integrated with petrochemical production, underscoring that deeply integrated complexes are more resilient and better positioned to thrive in a decarbonizing world.

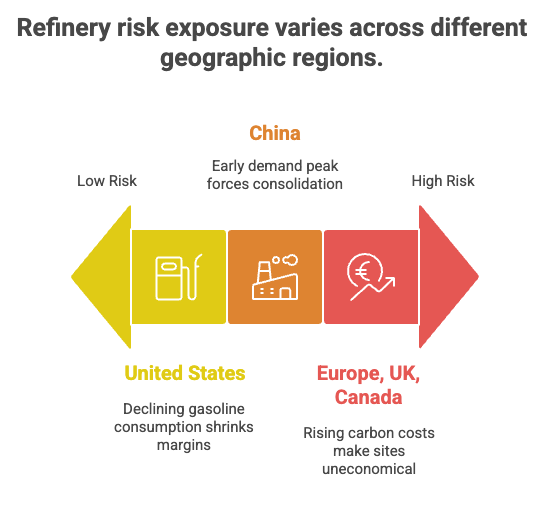

This wave of rationalization and conversion is not evenly distributed. Risk is concentrated in regions where carbon costs are escalating, gasoline demand is eroding, and capital expenditures for decarbonization are intensifying.

- Europe, UK, and Canada: Rising carbon pricing and stricter environmental compliance make many marginal sites uneconomical.

- United States: Declining gasoline consumption driven by electric vehicle (EV) adoption is shrinking margins.

- China: A demand peak earlier than anticipated is forcing consolidation, particularly among smaller independent refiners.

As a result, operators must decide whether to reinvest in modernization, pivot toward alternative operations like renewable fuels, or exit completely.

Drivers of the Refinery Rationalization Wave

Demand Mix Shift:

Gasoline demand is plateauing globally, especially in developed economies with accelerating EV penetration. Diesel and jet fuel demand remain stronger but are highly volatile, leaving catalytic-heavy, simple refineries under pressure.

Carbon and Compliance Costs:

Rising carbon prices and stricter environmental standards increase baseline operating costs, disproportionately impacting non-integrated refineries with limited petrochemical revenue streams.

Decarbonization Capital Needs:

Investments in hydrogen production, electrification, carbon capture and storage (CCS), and renewable feed flexibility are proving too expensive for many late-life assets.

Competition from Mega-Complexes:

Large-scale refineries in China and the Middle East benefit from scale, lower energy intensity, and petrochemical uplift, outcompeting older, less efficient plants globally.

2025: The Acceleration Begins

United States

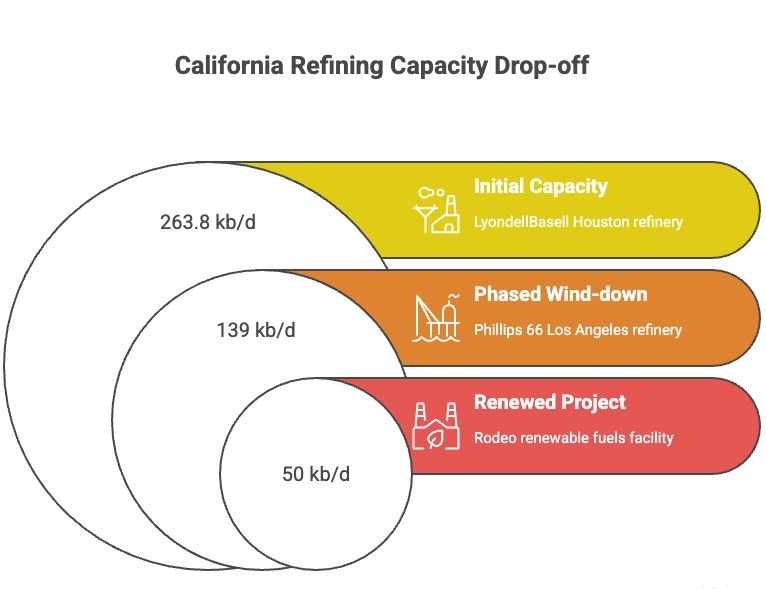

- LyondellBasell Houston (263.8 kb/d): Permanent closure in 2025, with hydrotreaters repurposed for recycled plastics production.

- Phillips 66 Los Angeles (~139 kb/d): Phased wind-down, ceasing operations by Q4 2025, impacting approximately 900 jobs.

- Rodeo Renewed Project: Successful conversion to a 50 kb/d renewable fuels facility producing renewable diesel (RD) and sustainable aviation fuel (SAF).

- Watchlist – Valero Benicia: Local reports indicate potential closure planning by April 2026. Combined with Phillips 66 LA, this could eliminate roughly 20% of California’s refining capacity.

Europe

- Grangemouth, UK (~150 kb/d): Crude processing ended on April 29, 2025. The facility is transitioning into a key import terminal.

- Grandpuits, France: Conversion into a zero-crude platform, focusing on SAF production and advanced plastics recycling.

China

Earlier-than-expected peak oil demand is projected to put 10% of refining capacity at risk over the next decade. Smaller independent “teapot” refiners are most vulnerable as the government drives consolidation toward large, coastal integrated hubs.

Regional Impact (2025–2030)

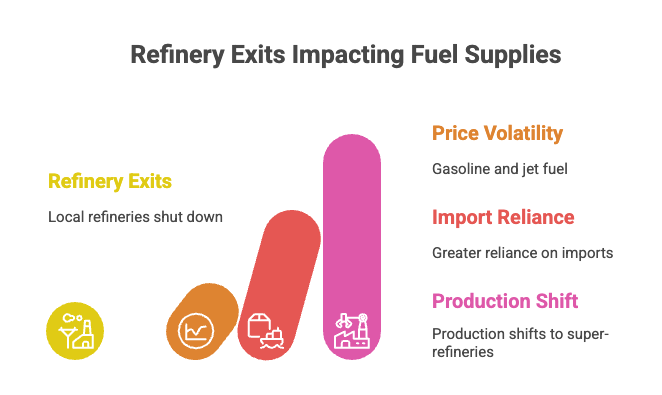

- California: Rapid refinery exits will tighten local gasoline and jet fuel supplies, increasing price volatility and reliance on imports that must comply with stringent CARBOB and LGIR specifications.

- UK and Northwest Europe: Greater reliance on imported products as local refineries shut down. Exposure to the EU Emissions Trading System (ETS) keeps marginal sites fragile.

- China: Independent refiners are expected to be phased out, shifting production to state-backed, petrochemical-integrated super-refineries.

Strategic Off-Ramps and Market Implications

Refineries are adapting by converting into renewable fuel and recycling hubs, as seen with Phillips 66 Rodeo, TotalEnergies Grandpuits, and Eni Venice/Gela, or shifting to logistics roles like Grangemouth. These transitions can cause temporary gasoline and diesel price swings, with diesel remaining more stable. Growing reliance on imports increases supply chain vulnerabilities. To stay competitive, operators should stress-test margins through 2035, integrate petrochemicals, focus on decarbonization projects like hydrogen and SAF, and consider terminal conversions where logistics value surpasses capital costs.

OMS Perspective

At OMS, we recognize that the refining landscape is entering one of the most turbulent decades in its history. As global capacity rationalizes and low-carbon transitions accelerate, we are focused on supporting operators and investors through:

- Scenario modeling to anticipate risks and opportunities.

- Margin stress-testing under various demand and carbon pricing scenarios.

- Evaluation of renewable and low-carbon projects to identify profitable pathways forward.

Our mission is to help industry stakeholders navigate volatility, unlock integration opportunities, and develop resilient strategies that position them for success through the 2025–2035 transition.