Oil Prices Plummet on US-China Trade Clash: A Stress Test for Refiners Seeking Resilience

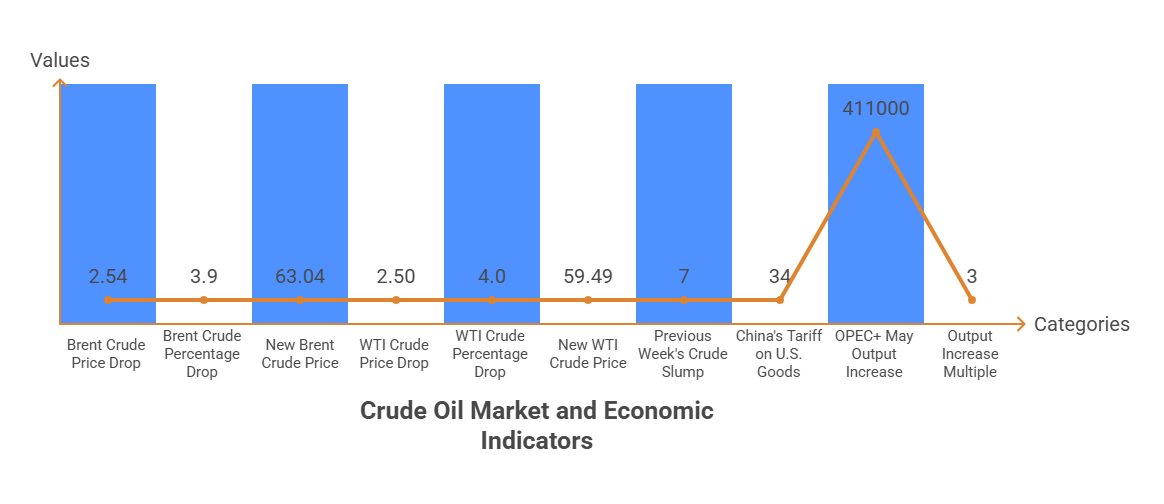

How can a single headline send crude prices or oil prices crashing and put refiners on red alert in the same breath? A fresh round of sparring between Washington and Beijing sent shockwaves through energy markets on Monday, knocking crude benchmarks to levels last seen in April 2021. By 07:45 GMT, Brent futures were down $2.54 (-3.9 %) at $63.04 a barrel, while U.S. West Texas Intermediate lost $2.50 (-4.0 %) to $59.49. The drop extends last week’s 7 % slump and lays bare just how jittery traders are about a trade-war–driven recession.

Wait—Why Did Oil Prices Drop So Fast This Time?

- Beijing hit back against a new round of U.S. tariffs with 34 % duties on key American goods.

- Energy commodities were spared, yet fears of slower industrial output—and therefore lower fuel demand—sent traders running for cover.

- “You won’t see a floor until the political noise dies down,” warned Vandana Hari of Vanda Insights, pointing squarely at the White House for the next move.

Trade Tensions Aren’t the Only Problem – Oil Prices Are Getting Hit from All Sides

The tariff headlines arrive on top of other headaches:

- Fed worries: Jerome Powell admitted on Friday that broader inflation and growth could take a bigger-than-expected hit.

- Demand erosion: Manufacturers have begun trimming production schedules, a sure sign that oil consumption will feel the pinch.

- Investor nerves: Equity markets wobbled in tandem, shrinking risk appetite across the commodity complex.

OPEC Just Threw Gasoline on the Fire – Did They Push Oil Prices Even Lower?

As if weaker demand weren’t enough, OPEC+ surprised markets by lifting its May output target to 411,000 bpd—roughly triple the increment traders had penciled in. That looming supply bump “is a big headwind for prices,” noted Sugandha Sachdeva of SS WealthStreet. Member nations that have overshot their quotas now have until April 15 to present catch-up plans, hinting at stricter enforcement but offering little near-term relief.

Geopolitics Strikes Again: What Global Tensions Mean for Oil Prices

- Iran: Tehran has closed the door on direct nuclear talks, raising the specter of sharper sanctions or regional flare-ups.

- Russia–Ukraine: New Russian gains in Ukraine’s Sumy region feed the wider risk premium.

Add those to trade-war tensions, and the macro picture looks even cloudier for crude bulls.

If You’re a Refiner, What Should You Do Next?

- Stress-test margins under lower-price, lower-throughput scenarios so you don’t get blindsided.

- Diversify your crude slate—heavier or discounted barrels can soften the blow when benchmarks sag.

- Tighten inventory management, balancing just-in-time deliveries against buffer stock for supply shocks.

- Stay laser-focused on compliance costs; tightening rules often bite hardest when revenues shrink.

One Last Thought: Tech Can Cushion the Blow

Strategic plans are great, but execution under fast-moving market stress needs real-time data and agile decision-making. Digital tools that optimize blending, flag regulatory risks early, and extract every penny from every barrel can transform volatility from a profit killer into an efficiency dividend. Offsite Management Systems LLC (OMS) offers exactly that sort of refinery-specific intelligence—helping operators protect margins and stay compliant, even when global headlines yank crude prices around by the hour.

How OMS Helps Refiners Stay Smart When Oil Prices Go Wild

When oil prices swing wildly, refineries can’t afford to watch and wait—and that’s where OMS steps in. Offsite Management Systems LLC helps refiners stay one step ahead with innovative digital tools explicitly built for this kind of chaos. Think real-time data, blending optimization, and compliance alerts—all working behind the scenes to protect your margins when markets get shaky. Whether it’s a trade war or a surprise move from OPEC, OMS gives operators the insights and agility they need to respond fast and stay profitable. In a world where headlines move barrels, OMS helps you move smarter.