Oil price outlook weakens on OPEC+ hikes, lingering trade concerns

OPEC’s Output Boost and Trade Jitters Knock the Shine Off Oil-Price Forecasts

June 1, 2025 | Reuters – Market Insights Desk

What happens when OPEC+ pumps more crude just as global trade worries threaten demand? Oil analysts are dialing back their expectations for 2025—again. A fresh Reuters poll of 40 economists now pegs Brent at $66.98 a barrel next year, nearly two dollars below last month’s call, with U.S. WTI seen at $63.35. Those projections are also several dollars under 2024’s year-to-date average, underscoring how quickly sentiment has cooled.

Why the Outlook Keeps Getting Trimmed

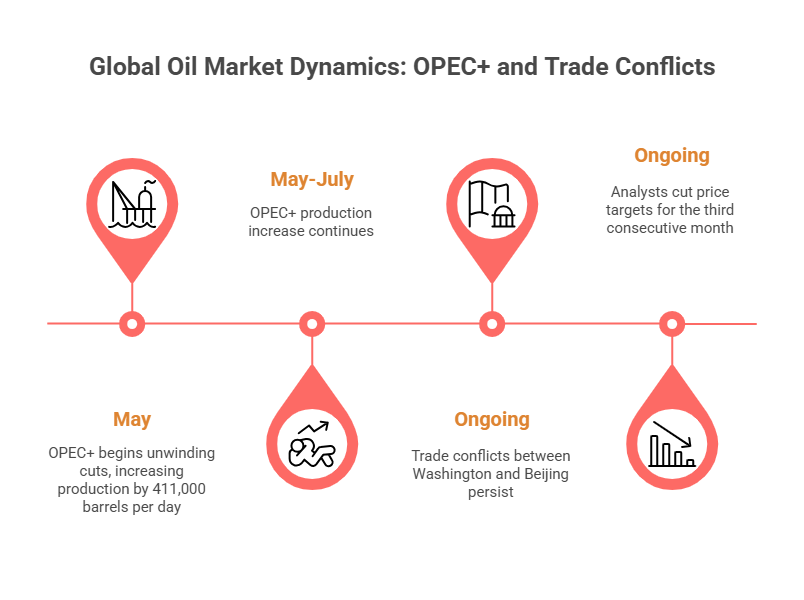

- OPEC+ turns on the taps. Eight member states began unwinding cuts in May, surprising traders with a chunky 411,000-barrel-per-day rise that could extend into July.

- Trade conflicts linger. Even after a détente with Europe, frictions between Washington and Beijing continue to hinder industrial activity, thereby fueling demand.

- Forecast fatigue. This is the third straight month analysts have cut price targets, reflecting nagging doubts about a second-half demand rebound.

Supply Side: A Cartel Flex—or a Warning Shot?

Many observers see the production hike as leverage, not charity. “The increase looks more like a message to quota-breakers than a bid to prop prices at any particular level,” says Suvro Sarkar of DBS Bank, noting that enforcing compliance, especially in Kazakhstan, will be tough. Still, more barrels on the market mean any price rally faces a lower ceiling.

Demand Side: Growth, but Not the Kind We’re Used To

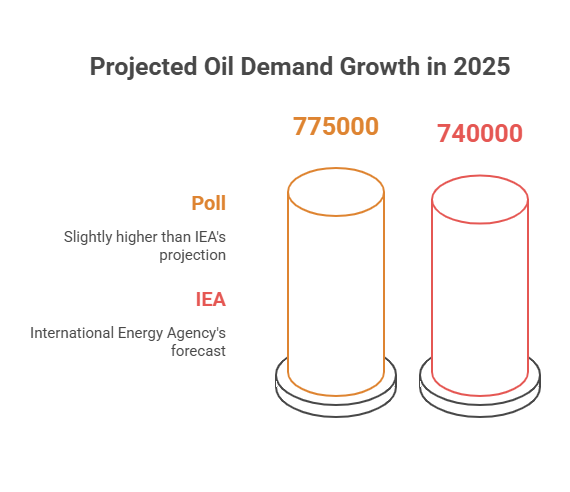

- The poll puts 2025 demand growth at 775,000 barrels per day, only a shade above the International Energy Agency’s latest 740,000-bpd call.

- Efficiency gains, softer U.S. gasoline use, and China’s pivot to electric mobility leave emerging producers to pick up the slack.

- Julius Baer strategist Norbert Ruecker calls it “a reshuffle, not a surge,” with resource-exporting nations now the primary driver of growth.

Wild Cards on the Horizon

- Russia–Ukraine risk premium. Markets have mostly priced in disruption, but any cease-fire talk—or tougher sanctions—could quickly swing sentiment.

- Sanctions roulette. A move to ease restrictions on Iranian or Venezuelan barrels would increase supply and put pressure on prices.

- Global slowdown watch. If trade skirmishes metastasize, demand could undershoot even today’s modest forecasts.

What Traders and Producers Can Do Right Now

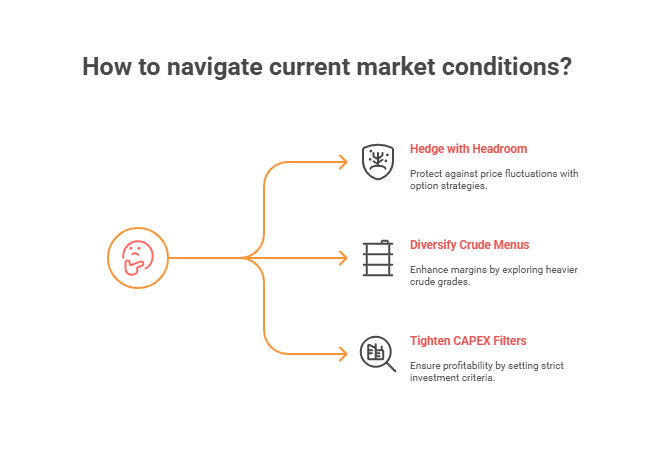

- Hedge with headroom. Option strategies that protect against a mid-$60s Brent scenario look prudent.

- Diversify crude menus. Refineries chasing wider discounts on heavier grades can cushion thinner margins.

- Tighten CAPEX filters. New upstream projects must break even well below $65 to win funding.

Bottom Line: Lower Lows, Shallower Highs

For now, analysts see more headwinds than tailwinds: a cartel willing to add barrels, a patchy economic backdrop, and a market that has lost its appetite for lofty price decks. Unless demand surprises to the upside—or geopolitics delivers a major shock—oil is entering the back half of 2025 with less pricing power than it carried into the year.

Digital tools that track real-time balances, flag cost creep, and stress-test price scenarios are becoming essential. Offsite Management Systems LLC (OMS) offers refinery-focused intelligence, helping operators preserve margins and stay compliant even when market reverts shift.