Dangote’s Buying Binge: Nigerian Mega-Refinery Locks in More U.S. WTI for July

2nd June 2025 | Reuters – Market Insights Desk

Why is the world’s newest mega-refinery snapping up U.S. crude just as OPEC+ adds barrels of its own?

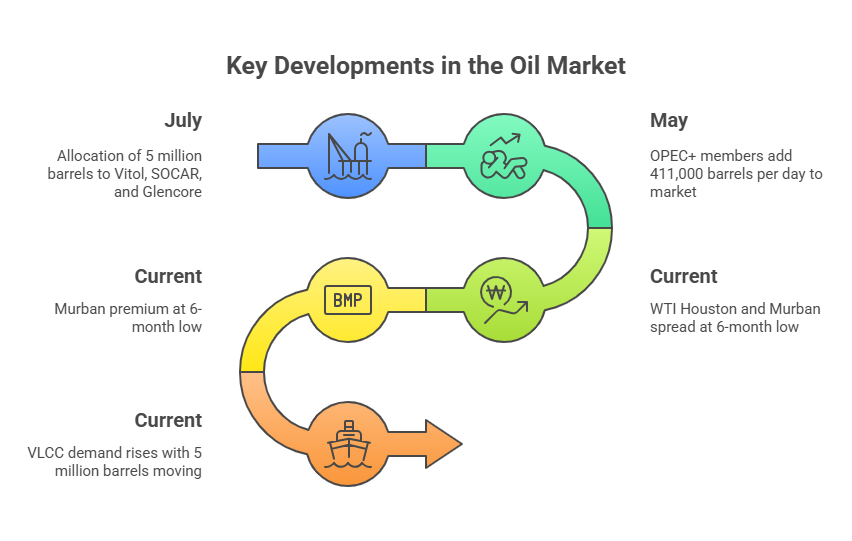

Nigeria’s 650,000-barrel-per-day Dangote Petroleum Refinery is showing no signs of slowing its appetite for American crude. Trading sources tell Reuters the Lagos-based complex has secured at least five million barrels of U.S. West Texas Intermediate (WTI) for July delivery—roughly 161,000 bpd, after booking a record 300,000 bpd for June. Final volumes could rise if more tenders are awarded in the coming weeks.

What’s Driving the Spree?

- Domestic shortfall: Nigeria’s upstream output remains well below capacity, leaving Dangote short of local feedstock.

- Price math: Competitive freight rates and softer WTI spot differentials make U.S. barrels a bargain versus Atlantic Basin rivals.

- Operational ramp-up: The plant, which has hovered near 80 % utilisation since March, is now targeting 85 % by October and needs steady supply to get there.

Who’s Selling the Barrels?

Commodity heavyweights split the latest tender:

- Vitol – 2 million barrels (July arrival)

- Socar – 2 million barrels

- Glencore – 1 million barrels

None of the traders commented on pricing, but market chatter suggests the cargoes are at a modest premium to the benchmark WTI Houston, reflecting stiff competition among exporters as OPEC+ production increases.

A Global Tug-of-War for Market Share

U.S. grades are fighting harder for homes in Asia, where a six-month low premium on UAE Murban is luring refiners eastward. Dangote’s demand offers a timely outlet:

- WTI vs. Murban: The spread has narrowed to under $1 per barrel, erasing much of Murban’s freight advantage into India and China.

- OPEC+ surge: Eight cartel members began unwinding cuts in May, adding 411,000 bpd and signalling another hike could follow at this weekend’s ministerial. More supply pressures light-sweet differentials worldwide.

Implications for Nigeria—and Everyone Else

- Local crude under pressure: Each imported barrel displaces a Nigerian grade that might have cleared at a premium. Producers could be forced to discount to keep their domestic market share.

- Atlantic Basin flows realign: With Dangote pulling WTI, more U.S. cargoes may bypass Europe altogether, tightening North Sea pricing chains.

- Freight market boost: VLCC demand out of the U.S. Gulf jumps whenever Dangote books multi-cargo tenders, lifting trans-Atlantic tanker rates.

Can the Buying Last?

The refinery’s head, Edwin Devakumar, says Nigerian grades remain the “preferred diet,” but pipeline issues and fluctuations in condensate quality mean imports are here to stay. Analysts at Kpler note the plant has also tapped Angola, Equatorial Guinea, Algeria, and Brazil this year, hinting at a flexible crude slate until local supply stabilises.

Still, Dangote must juggle economics: U.S. barrels incur longer voyages and higher demurrage risks. If OPEC+ barrels become further, especially from fellow West African producers, the refinery could pivot.

What Refiners Can Learn

- Lock optionality: Spread tenders across suppliers (Vitol, Socar, Glencore) to avoid single-point risk.

- Model run-rates dynamically: Blend optimisation can tweak crude recipes as relative pricing shifts.

- Watch freight swings: Tanker tightness can erase apparent crude discounts in a heartbeat.

One Last Thought: Digital Eyes on Every Barrel

When a 650 kbpd refinery sources crude from five continents, margin protection hinges on real-time data. Tools that track voyage costs, crude assays, and swing-unit constraints hour-by-hour turn a buying spree into an earnings edge. Offsite Management Systems LLC (OMS) equips refiners with exactly that intelligence—optimising blend selections, predicting unit bottlenecks, and flagging cost creep before the ship even docks. In a market where one tender can shift global differentials, that kind of clarity can mean millions.