$14 billion in clean energy projects have been canceled in the US this year, analysis says

$14 Billion in Clean-Energy Projects Just Got the Axe—Let’s Talk About Why

May 30, 2025 |

How did one tax debate on Capitol Hill freeze billions in clean-energy spending and leave developers wondering what to do next?

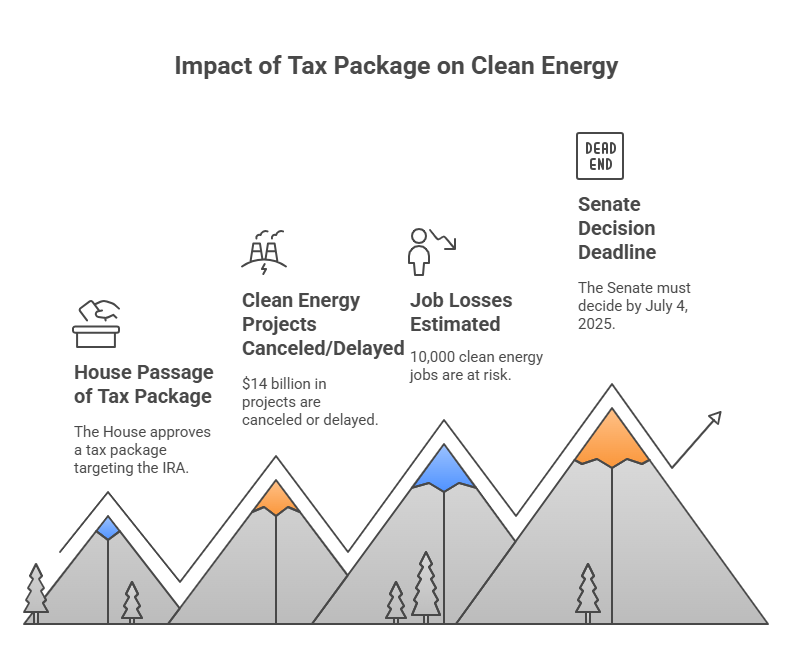

If 2024 was all about record-breaking announcements in batteries, EVs, solar, and wind, 2025 has been the year of the big back-pedal. A new analysis from environmental group E2 and consultancy Atlas Public Policy says more than $14 billion worth of U.S. clean-energy projects have already been canceled or pushed to the sidelines since January, along with an estimated 10,000 jobs that were supposed to come with them. The pause button got slammed the moment the House passed a sweeping tax package that would gut the landmark incentives baked into 2022’s Inflation Reduction Act (IRA). The Senate now has a soft July 4 deadline to decide whether those credits live or die, and the industry is holding its breath.

Why Clean Energy Funding Is Disappearing Overnight in 2025

- Tax-credit whiplash. Developers priced projects assuming federal rebates on every battery cell, EV, and solar panel. If those credits disappear, the spreadsheets stop adding up fast.

- Show-me-the-money anxiety. Lenders hate uncertainty. Until the Senate votes, cheap financing has dried up, and equity investors are parking cash elsewhere.

- The flight-risk factor. “If the rules can flip that quickly, why not build in Europe or Southeast Asia instead?” asks E2’s Bob Keefe. Many CEOs seem to agree.

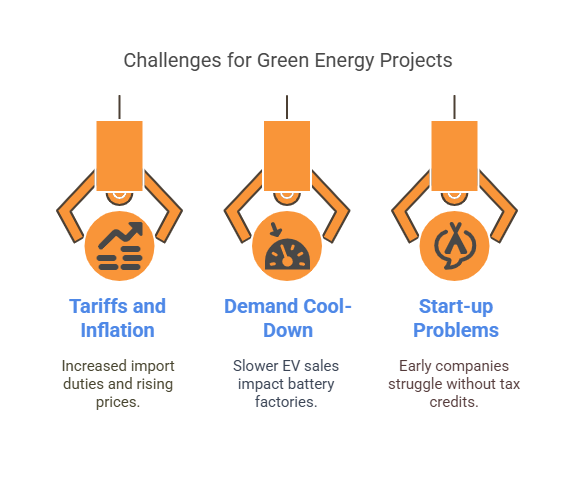

It’s Not Only About Congress

- Tariffs & inflation. Higher import duties on critical minerals, plus pricier steel and labor, squeeze project margins that were already razor-thin.

- Demand a cool-down. EV sales, after two blockbuster years, are finally hitting speed bumps. Fewer cars sold means fewer battery gigafactories needed, for now.

- Start-up growing pains. Early-stage hydrogen and next-gen battery companies were counting on tax credits to get them over the “valley of death.” Without the safety net, some are folding their tents.

Big Dreams, Sudden Stops: Here Are the Headlines

- Kore Power’s $1 billion battery plant in Arizona? On ice “indefinitely.”

- BorgWarner just scrapped two EV component lines in Michigan.

- Bosch paused its $200 million hydrogen fuel-cell expansion in South Carolina after “reassessing market conditions.”

Dozens of smaller solar farms, wind projects, and storage sites quietly backed out of grid-connection queues rather than gamble on disappearing incentives.

Red States Feeling the Blues

Irony alert: about $12 billion of the shelved projects sit in Republican-led states and districts—the very places that lured the most IRA-based factory announcements during 2023-24. Georgia and Tennessee, both staking their futures on electric vehicle (EV) supply chains, now face half-built plants and worried local officials. “These investments lifted entire counties,” notes Georgia Tech professor Marilyn Brown. “Losing them mid-stream could be devastating.”

Jobs on the Line

E2’s running tally puts 10,000 clean-energy positions in limbo so far this year, from forklift drivers in South Carolina to chemical engineers in Michigan. Cornell engineer Fengqi You warns the layoffs could snowball if the tax bill passes unchanged: “Factories midway through construction may simply never open.”

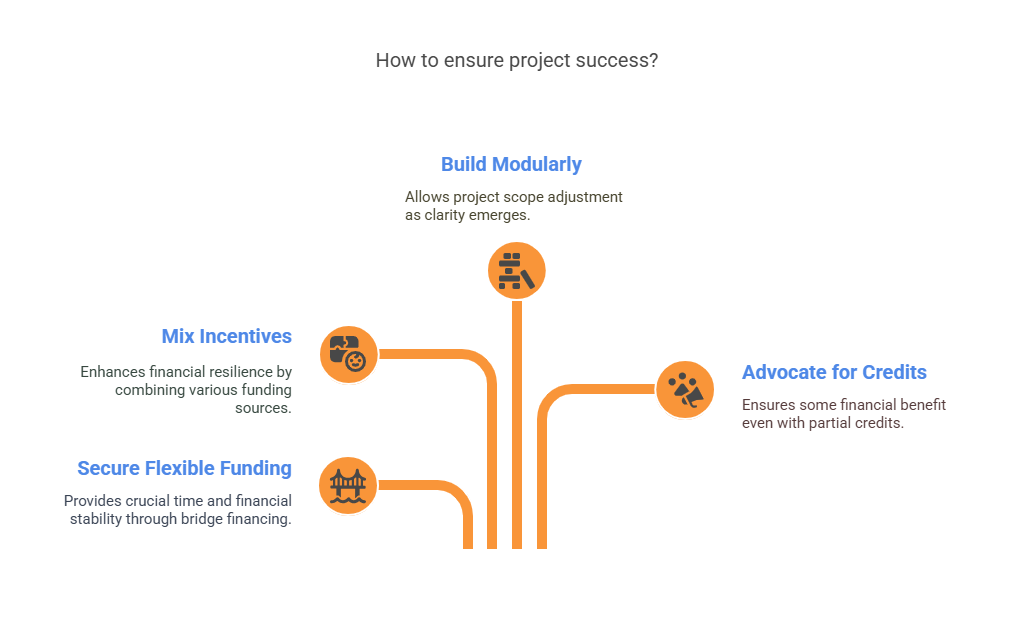

What Developers Can Do While the Dust Settles

- Lock in bridge financing with cushions for policy delays—yes, it costs more, but it buys time.

- Blend incentives. Pair whatever’s left of federal credits with state clean-energy funds or corporate power-purchase agreements.

- Design with Legos, not concrete. Modularity lets you scale phases up or down as policy clarity improves.

- Stay loud in Washington. Even a trimmed-down credit package beats having none at all.

A Quick Reality Check

Policy uncertainty is nothing new in the energy world, but the speed and scale of this year’s reversals are eye-opening. Mega-projects live or die on timing; a single Senate vote can turn a billion-dollar plan into an expensive paperweight. Digital scenario-planning tools that model tax swings, supply-chain shocks, and regulatory curveballs in real time have never been more valuable. Offsite Management Systems LLC (OMS) specializes in precisely that kind of intelligence—helping developers stress-test budgets, optimize build schedules, and keep projects viable even when policymakers keep moving the goalposts. In a game where the rules can flip overnight, having that data at your fingertips might be the difference between breaking ground and walking away.